Reddie & Grose: Mapping the future of security tech

Eve Goode

Share this content

International Security Journal hears exclusively from Drew Rudhall, Senior Associate at Reddie & Grose about emerging technologies in security and defence.

The latest innovations in security from patent filings

In today’s rapidly evolving threat landscape, governments and defence companies are investing heavily in research and development (R&D) to stay ahead of emerging threats and commercialise new technologies.

The UK government, for example, plans to spend £1.7 billion on defence-focused R&D in 2025–26, rising to £2.4 billion by 2029–30.

This increase aligns with a broader rise in defence spending, which is set to grow from 2.6% of GDP in 2026 to 3% by 2029.

While the US has recently reduced its Department of Defense R&D budget, it still leads globally, allocating $141 billion for fiscal year 2025.

In contrast, defence R&D spending in the EU and China is harder to quantify.

EU countries fund R&D through both national and EU-level budgets, with total defence R&D estimated at €13 billion in 2024.

China’s figures are less transparent but its 2023 defence R&D spending was estimated at €21 billion. As global R&D investment grows, so does the number of patent applications.

While some defence innovations remain classified, many are patented to protect intellectual property and secure future revenue.

These public filings offer valuable insights into the emerging technologies that are considered close to commercialisation.

As well as into the strategies and focus of the companies and countries driving this innovation.

An effective means of analysing these trends is through the International Patent Classification (IPC) system, developed by the World Intellectual Property Organization (WIPO).

IPC codes categorise patents by technical subject matter, allowing us to track developments in specific areas of security technology.

We can look at particular classifications that relate to security, using them as a proxy through which to understand which regions and organisations are making the major advances in these fields.

Secret communications and countermeasures (IPC H04K)

Patent filings related to secret communication, jamming and countermeasures (IPC code H04K) have surged in recent years.

China dominates this category with Shenzhen An Wei Pu Technology Co leading a spike in filings in 2023.

In 2024, Qualcomm Inc. (US) became the top filer in this category. Overall, China’s filings in H04K rose from 129 in 2016 to a peak of 512 in 2022.

Meanwhile, US filings have declined annually since 2016, when the US last outpaced China in this area. European filings have remained relatively stable year on year.

Unmanned aerial vehicles (IPC B64U)

Given the increasing role of drones in modern warfare, it’s no surprise that patent filings for unmanned aerial vehicles (UAVs) have grown significantly.

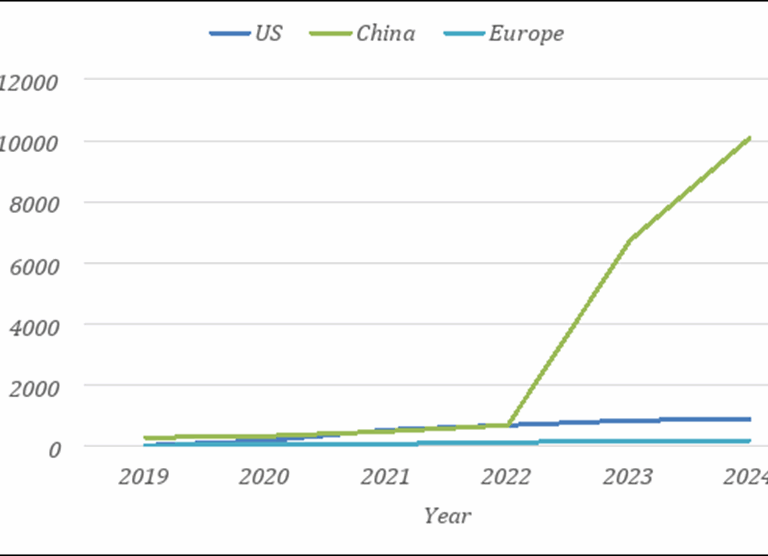

A notable rise began in 2021, with China showing a dramatic increase in 2023.

As shown in Figure 1, China’s filings jumped from 652 in 2022 to 6,682 in 2023 and further to 10,064 in 2024. In comparison, US filings reached 866 in 2024, while Europe’s filings remained modest.

Although drones are becoming increasingly popular consumer gadgets, it is notable to see such a sharp increase in patent filing activity from one country.

Evidently, drones are hugely significant from a commercial perspective. This marked disparity between the US and China suggest that China is the dominant player.

In 2024, the top five applicants in the B64U category were:

- Wing Aviation LLC (US)

- State Grid Corporation of China

- Kubota Co (Japan)

- XAircraft Co Ltd (China)

- Nanjing University (China)

While companies like Wing Aviation and Kubota are significant players, the sheer number of Chinese applicants supports China’s overall dominance in drone innovation.

Explosives and weapons (IPC C06 and F41)

Similar trends are seen in other categories such as explosives (C06) and weapons (F41), where Chinese entities consistently file more patents than their counterparts in other countries.

Although the growth in these categories is more stable, the volume of filings still reflects China’s strong focus on defence innovation.

It’s important to note that a high number of patent filings doesn’t necessarily equate to technological superiority.

However, the data does suggest that China’s extensive R&D efforts are yielding a significant volume of innovation.

In many areas, Chinese companies appear to be outpacing their Western counterparts.

Strategic implications

Most critical military technologies are unlikely to be disclosed in public patents. Instead, governments often incentivise companies through contracts for innovations deemed too sensitive for publication.

Advancements in consumer electronics often spill over into defence applications. China’s leadership in consumer drone technology, for instance, could easily translate into military advantages.

As patent filings continue to grow, they offer a valuable lens through which to observe the shifting dynamics of global defence innovation.

China’s aggressive push in key technology areas underscores its strategic intent, while Western nations may need to reassess their R&D strategies to remain competitive.

To remain competitive in this evolving landscape, governments should closely monitor patent filing activity as part of their strategic planning.

Patent trends not only signal technological momentum but also highlight where skills and expertise are being cultivated globally.

By integrating patent intelligence into defence policy, governments can better assess whether their domestic industries possess the necessary capabilities to keep pace with international innovation.

This approach can help ensure that national defence sectors are equipped with the knowhow required to respond effectively to emerging threats and maintain technological sovereignty.