What is a Digital ID?

Simon Burge

Share this content

Key Takeaways

- A digital ID is a secure, electronic form of identity that allows individuals to verify who they are online or in person.

- They’re used across various sectors including banking, healthcare, education, and government to streamline access and reduce identity fraud.

- Digital IDs can be centralised or decentralised, with growing emphasis on user control and privacy.

- Benefits include convenience, efficiency, and interoperability, while risks include privacy concerns, data breaches, surveillance, and exclusion.

- The future of digital identity is likely to intertwine with digital wallets, enabling individuals to manage all aspects of their identity securely from their devices.

In an increasingly connected world, a digital ID is a secure electronic version of your identity that allows you to prove who you are in person or online without the need for physical documents.

It contains verified sensitive personal information such as your name, age, and date of birth, which can be shared safely and selectively with organisations or services that need to confirm who you are.

From unlocking your phone with facial recognition to proving your age when buying age-restricted goods, digital IDs are transforming how we identify ourselves; securely, conveniently, and often with more control over our personal data storage than ever before.

Article Chapters

Toggle- Key Takeaways

- What is a Digital Identity?

- Reasons for Introducing Digital IDs

- Which Countries are Implementing Digital ID?

- Traditional vs Decentralised Digital IDs

- Types of Digital ID

- Benefits of a Digital ID

- Pitfalls of a Digital ID

- Will Digital IDs Merge with Digital Wallets?

- Final Thoughts

What is a Digital Identity?

A digital identity is the electronic equivalent of a physical form of identification, such as a passport, driving licence, or ID card; but stored securely in digital form.

It enables individuals to verify their identity, control access services, or complete transactions online and offline without relying on paper-based documents.

Digital IDs work by linking an individual’s verified information such as name, date of birth, photo, biometric data, or unique digital credentials to a digital record.

This record is securely stored on a device, database, or cloud platform and can be used to confirm identity with government agencies, healthcare providers, banks, or private companies.

Digital IDs are increasingly designed to be interoperable across multiple services, so a single ID can be used for everything from filing taxes to proving your age when purchasing in a store.

Reasons for Introducing Digital IDs

The push towards digital identification stems from a mix of security, efficiency, accessibility, and inclusion.

Governments and organisations around the world are exploring digital ID frameworks for several reasons.

Prevents ID Fraud

Traditional identification methods can be forged, lost, or stolen.

Digital IDs reduce this risk by using biometric authentication (like fingerprints or facial recognition) and cryptographic encryption to make fraud and impersonation significantly harder.

Access to Governmental Services

Many countries are integrating digital IDs into their public systems to make citizen services faster and more accessible.

For example, Estonia’s e-ID allows residents to vote online, access healthcare, and pay taxes from a single platform.

By streamlining identity verification, governments can cut down on paperwork, speed up service delivery, and reduce administrative costs.

Access to Healthcare and Medicine

In healthcare, digital IDs ensure patient information is verified and accessible only to authorised individuals.

This reduces fraud, helps track vaccination and prescription records, and improves continuity of care between medical providers.

Access to Online Learning and Education

Educational institutions increasingly use digital IDs to confirm student enrolment, verify exam attendance, and issue verified digital certificates or qualifications.

This helps combat credential fraud while simplifying cross-border recognition of academic achievements.

Access to Banking and Finance

Financial institutions rely heavily on identity verification to comply with Know Your Customer (KYC) regulations.

Digital IDs make this process faster and safer, allowing users to open accounts, transfer money, or apply for loans securely and remotely.

Access to Social Media

As online impersonation, fake accounts and minors accessing adult content becomes major a concern, some platforms are exploring verified digital ID integration to prove users’ authenticity and enhance trust.

This could also help curb cyberbullying, misinformation, and identity theft.

Smart Cities

Digital IDs play a role in smart city ecosystems, where connected infrastructure such as transport systems and public services, that rely on accurate, verified identities to function efficiently.

Internet of Things (IoT)

In IoT environments, digital IDs aren’t just for people; they can also apply to devices.

Assigning unique digital identities to devices helps ensure they communicate securely and only with authorised networks.

Metaverse

As virtual environments evolve, digital IDs are expected to become fundamental to establishing verifiable online identities within the metaverse.

This allows users to carry proof of age, ownership, and credentials across various platforms safely.

Which Countries are Implementing Digital ID?

Digital identity systems can be found in many countries around the world, but the maturity, reach, and complexity of those systems varies greatly.

Below is a selection of notable cases, both fully implemented systems and those under development:

Countries with Fully Operating Digital IDs

The following countries have relatively mature digital identity systems that are used at scale in public and private services:

Estonia (e-ID / e-Estonia)

Estonia is often regarded as one of the most advanced digital identity nations.

Every resident receives a state-issued electronic ID (e-ID) which is mandatory and integrated into most public and private services.

Functions include digitally signing documents, voting online, accessing health records and social services, conducting banking, and paying taxes.

India (Aadhaar)

Indian residents are issued a 12-digit unique identity number (Aadhaar), linked to biometric data (fingerprints and iris scans) and demographic attributes.

Aadhaar is used for subsidies, direct benefit transfers, KYC (banking), and as a foundational identity in many services.

Sweden (BankID)

BankID is a widely used electronic identity system in Sweden, issued by banks.

It’s used to verify identity for financial services, government interactions, and private services.

It’s extremely commonplace, since a large percentage of Swedish citizens rely on it for everyday digital activities.

Denmark (MitID)

Denmark uses MitID as a national digital identification and authentication system.

It allows access to public e-services, digital banking, and is built to comply with EU digital identity frameworks.

Others EU Nations

- Germany: issues eID cards which are accepted for electronic identification.

- Austria: has launched “ID Austria” allowing citizens to access digital services and authenticate online.

- Spain: operates digital national ID (DNI / eDNI) systems.

- Finland & Norway: both countries accept bank-issued eIDs or government-issued electronic identification for public and private sector interaction.

- Belgium: has had digital ID arrangements (BelPIC, etc.) for online authentication.

Vietnam (VNeID)

Vietnam’s digital ID platform (VNeID) functions as a “super app” and central digital identity system maintained by the Ministry of Public Security.

It allows users to authenticate identity, access e-government services, store and verify documents, and reduce reliance on physical documents.

China (RealDID)

China has introduced a national decentralised identifier system called China RealDID, launched in late 2023, which supports blockchain-based identity credentials.

While China has long enforced real-name registration in many online services, RealDID formalises a cryptographic identity layer allowing encrypted identity proofs.

Jordan (Sanad)

Jordan’s Sanad app is its government digital identity e-government services platform.

It offers unified access to more than 550 services from public and private entities, and supports digital authentication, document viewing, and service applications.

Sri Lanka (SL-UDI)

Sri Lanka is rolling out a digital identity known as SL-UDI integrated via its eLocker mobile app.

During a transition period, national ID cards remain valid while the digital ID is phased in.

Countries with Digital ID Systems Coming Soon

Many countries are actively exploring, piloting, or planning national digital IDs or digital identity wallets.

Here’s some notable examples:

United Kingdom (GOV.UK Digital ID)

The UK has announced plans for a digital ID to be installed via a smartphone app (digital wallet) for proving identity, including mandatory use for Right to Work checks.

As of late 2025, the government intends the system to simplify access to services like driving licences, welfare, tax records, and more.

European Union (EU Digital Identity / eIDAS)

Under the updated eIDAS regulation, all member states are required to support EU Digital Identity Wallets.

These are intended to enable cross-border recognition of identities and credentials within the EU.

Pilot projects are underway in Denmark, France, Greece, Italy, and Spain for age verification and wallet deployment in advance of full rollout.

Poland (mObywatel App)

Poland has a mobile app mObywatel with digital identity features.

Citizens can show digital versions of ID or driving licence, check vehicle data, local services, and polling information.

The app is not necessarily the same as a full foundational digital ID, but it functions as a step in that direction.

Switzerland (New e-ID)

In a 2025 referendum, Swiss residents narrowly approved a new state-run e-ID system for legal residents.

This digital identity will coexist with physical documents and aims to give people a digital means to prove identity in transactions and government services.

Costa Rica (IDC-Ciudadano)

Costa Rica launched a digital ID card in September 2025, offering citizens an alternative to physical identity documents.

Austria (ID Austria)

Austria introduced ID Austria in 2023, allowing authentication for online services and identity verification digitally.

Other Regions

- Latin America & Caribbean: many countries in the region are expanding digital ID systems, often under broad mandates of state digital transformation.

- Sub-Saharan Africa: numerous states rely on foundational digital IDs or e-registry systems, though many remain in earlier stages of implementing secure identity verification.

A dataset suggests that out of 210 countries, 164 claim to have some form of digital or electronic ID system; but fewer (around 93) are in active rollout stages.

Traditional vs Decentralised Digital IDs

There are two main approaches to digital identity systems: traditional and decentralised.

Traditional Digital IDs

Traditional digital IDs are typically centralised, meaning a single authority such as a government or company verifies and stores identity information.

While these systems are easier to regulate and manage, they can raise concerns about data privacy, centralised control, and the potential misuse of information.

Decentralised Digital IDs

In contrast, decentralised digital IDs (DIDs), sometimes called self-sovereign identities, allow individuals to own and control their data directly.

Information is stored securely on a user’s device or within a blockchain-based wallet, and only essential data is shared when needed.

For instance, if someone needs to prove they’re over 18, a decentralised ID could confirm that fact without revealing their date of birth or name, offering both security and privacy.

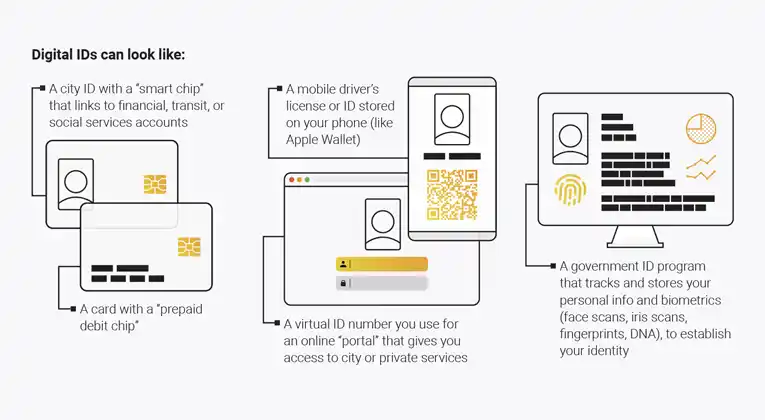

Types of Digital ID

Government-Issued Digital ID

These are official digital versions of national identification systems, issued and verified by governments. Existing examples include:

- Estonia’s e-ID: one of the most advanced national systems, integrated across public and private services.

- India’s Aadhaar: the world’s largest biometric ID programme, covering over a billion citizens.

- Australia’s Digital ID: used for both government and private-sector identity verification.

Decentralised Digital IDs

As mentioned earlier, decentralised IDs give users control over their own credentials through technologies like blockchain.

No central databases store user data, thus reducing the risk of large-scale breaches.

Corporate Digital IDs

Corporations such as Apple, Google, and Microsoft provide digital identity tools for accessing devices, cloud services, and enterprise systems.

These are often used within workplace ecosystems or customer-facing authentication systems.

Third-Party Authentication

Third-party systems, like logging in via “Sign in with Google” or “Sign in with Facebook”, are a common example of digital identity verification.

While convenient, they rely on data-sharing agreements that may raise privacy concerns.

Benefits of a Digital ID

Convenience

Digital IDs eliminate the need to carry multiple physical documents.

They enable one-tap or one-scan verification across multiple platforms, saving time and reducing paperwork.

Eliminates Multiple Logins

By consolidating credentials, digital IDs make it easier to log into multiple services securely.

Single sign-on solutions simplify digital life while maintaining robust security protocols.

Cross Compatibility

Well-designed digital ID systems can be used across sectors, from healthcare to finance, making identity management seamless and universally recognisable.

Pitfalls of a Digital ID

While digital IDs promise efficiency and inclusion, they are not without controversy.

Standardisation

Global compatibility remains a challenge.

Different countries and organisations often use varying systems that may not communicate with each other effectively.

Privacy and Data Breaches

Many critics claim digital IDs present a major cyber security issue.

Even with encryption, no system is entirely immune to data breaches.

When large-scale digital ID systems are compromised, the consequences can be severe because the stolen information is so comprehensive.

Increased Surveillance and Data Collection

Critics warn that digital IDs could enable governments or corporations to track citizens’ movements and online behaviour more closely.

They argue this could potentially lead to misuse of data or infringement of privacy rights and civil liberties.

Access Inequality and Exclusion

Digital ID systems can inadvertently exclude individuals without access to technology, reliable internet, or official documentation.

Vulnerable populations may be disproportionately affected if digital IDs become a requirement for essential services.

Legal & Regulatory Challenges

As digital ID systems expand globally, laws around data protection, consent, and cross-border recognition remain inconsistent.

Establishing international standards is essential to avoid misuse and ensure trust.

Public Support

Public acceptance is absolutely crucial.

Without transparency about how data is used, stored, and protected, citizens may resist adopting digital ID systems altogether

Will Digital IDs Merge with Digital Wallets?

Over time, this is increasingly likely.

Digital IDs are expected to become a key feature of digital wallets.

Digital wallets are apps that not only store payment information, but also verifiable credentials like passports, driving licences, and qualifications.

The European Union’s proposed European Digital Identity Wallet is one example.

It would allow citizens to store and present official documents digitally, all while maintaining strict privacy controls.

This integration could make everyday transactions smoother, from renting a car to proving vaccination status, but it will require robust encryption, interoperability, and international trust frameworks.

Final Thoughts

Digital IDs represent a major step forward in how we manage identity in the digital era.

When designed ethically, transparently, and inclusively, they can simplify life, reduce fraud, and enhance global connectivity.

But their success depends on maintaining a delicate balance between innovation and privacy, convenience and consent, and efficiency and equity.